Evergrande Liquidation Ordered: A $30 Billion Debt Crisis Unfolds!

At 1:53 AM on January 30, 2024, Carine Knapen reported that China’s major real estate company, Evergrande, is set to be liquidated by court order. Unable to repay its $30 billion debt and failing to present a reconstruction plan, Evergrande faces liquidation, entailing the sale of its assets worldwide to settle its debts. This significant development raises questions about the potential global impact of the liquidation on markets and economies.

CHINESE VASTGOED GIGANT EVERGRANDE OP BEVEL VAN RECHTBANK IN LIQUIDATIE.

WAT ZIJN DE MOGELIJKE CONSEQUENTIES ?Vandaag is Evergrande, na 2 jaar struikelen, vallen en weer opstaan, op bevel van de rechtbank in liquidatie gesteld omdat zij haar 300 miljard dollar geconsolideerde… pic.twitter.com/ycXfJgVdke

— Carine Knapen (@CarineKnapen) January 29, 2024

User Reactions:

- Ashanata Meditatie en Healing: “Thank you, Carine. Your contribution as a legal expert is valuable.”

- Draakje: “Today.”

- roland Olislaegers: “Carine, I don’t see much Chinese influence in Evergrande’s portfolio.”

- Erik Fijlstra: “The stock market doesn’t seem to react much to this issue. The impact might not be that significant.”

- Magiknognadenken?: “This liquidation will lead to bankruptcy soon. Major creditors will buy back at low prices and resell later for profit.”

- J-3,14-W: “That $30 billion is Western financing, China might not be that foolish.”

- Markus: “Previous articles reported minimal impact on Western banks and profits.”

- Frans Frans: “A new crisis like 2008?”

- Gunter: “The overall discussion lacks small details about Hong Kong. It’s questionable if China will follow this.”

- Peter Struik: “Whether the last part you mentioned will happen is questionable due to increasing instability.”

- Jan De Laet: “Evergrande has a lot of debt but also many assets. GM also went bankrupt.”

- Hugo B3680: “The second chapter of Lehman Brothers.”

- HouseOfSun: “I don’t think China will follow a Hong Kong court’s decision.”

- Birdie Hunter: “Evergrande’s bonds will lose value, and many banks used them as collateral, so these banks will face margin calls.”

- Claeys Gerlinda: “Thank you, Carine. Rumors are already spreading at my workplace.”

- Mirjam ©️: “Interesting, thanks Carine!”

- ElisaNada: “Interesting content. Something to keep in mind.”

- Sharon: “What will happen in the West?”

- Madeliefste: “This situation provides globalists a perfect opportunity to rapidly advance CBDC.”

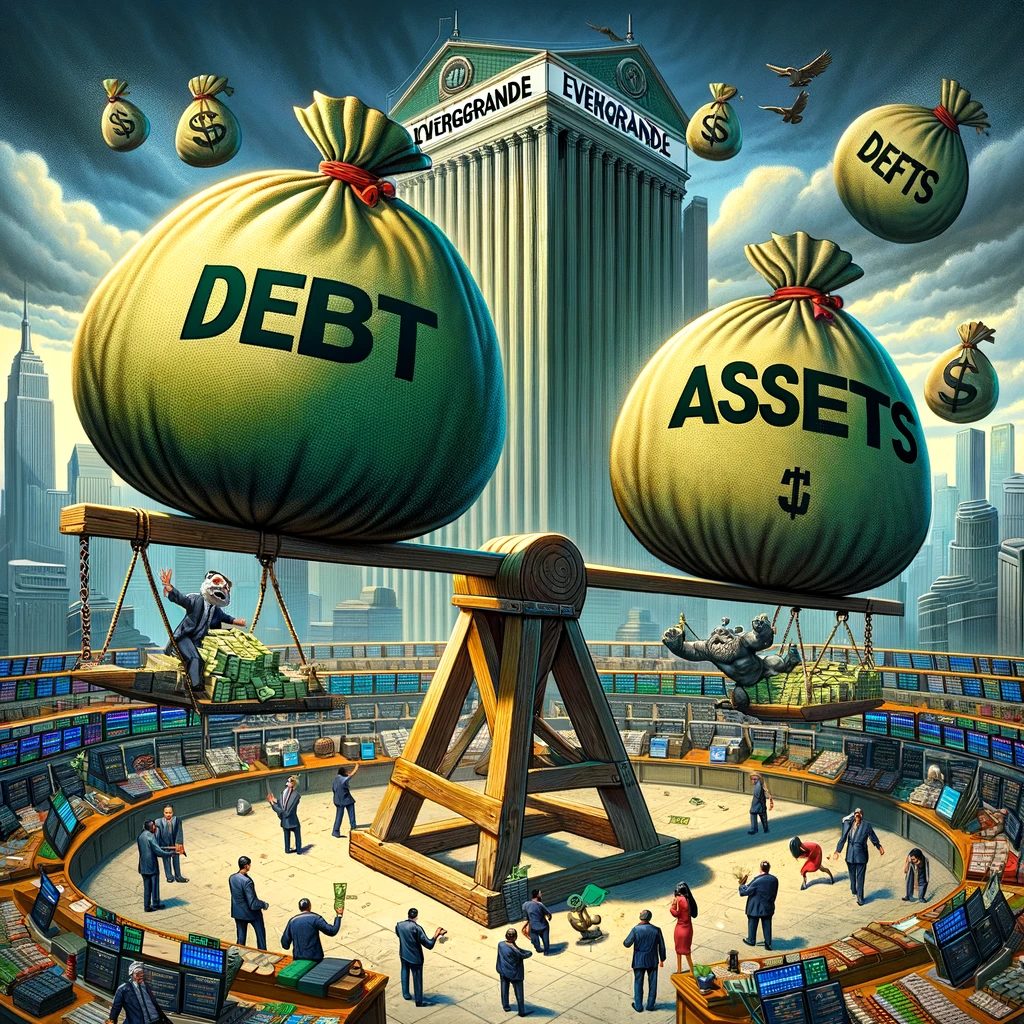

The news of Evergrande’s liquidation has elicited a broad spectrum of reactions, ranging from legal and financial analysis to speculation about wider economic impacts. Users are expressing concerns about potential ripple effects on global markets, comparing the situation to past financial crises, and pondering the implications for the future of digital currencies. This development underscores the interconnected nature of global finance and the potential for significant events in one nation to have worldwide consequences. Let’s create an image to visually represent the complex scenario surrounding Evergrande’s liquidation.